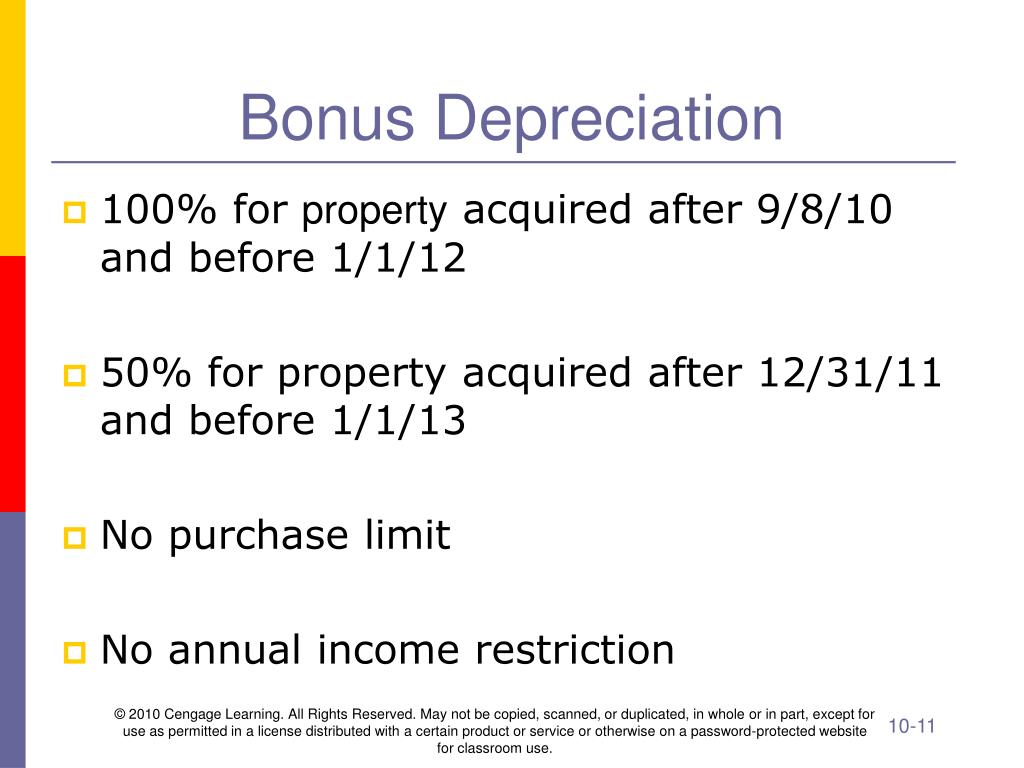

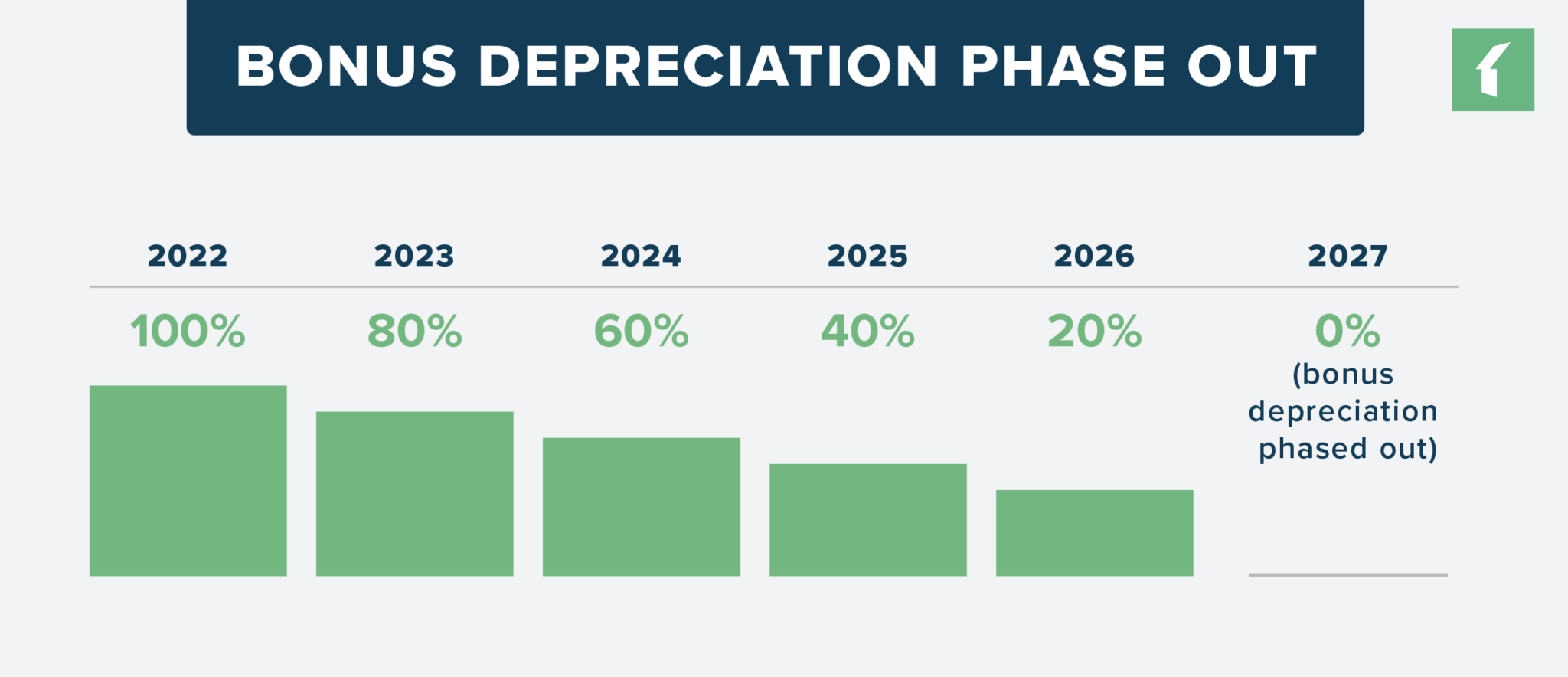

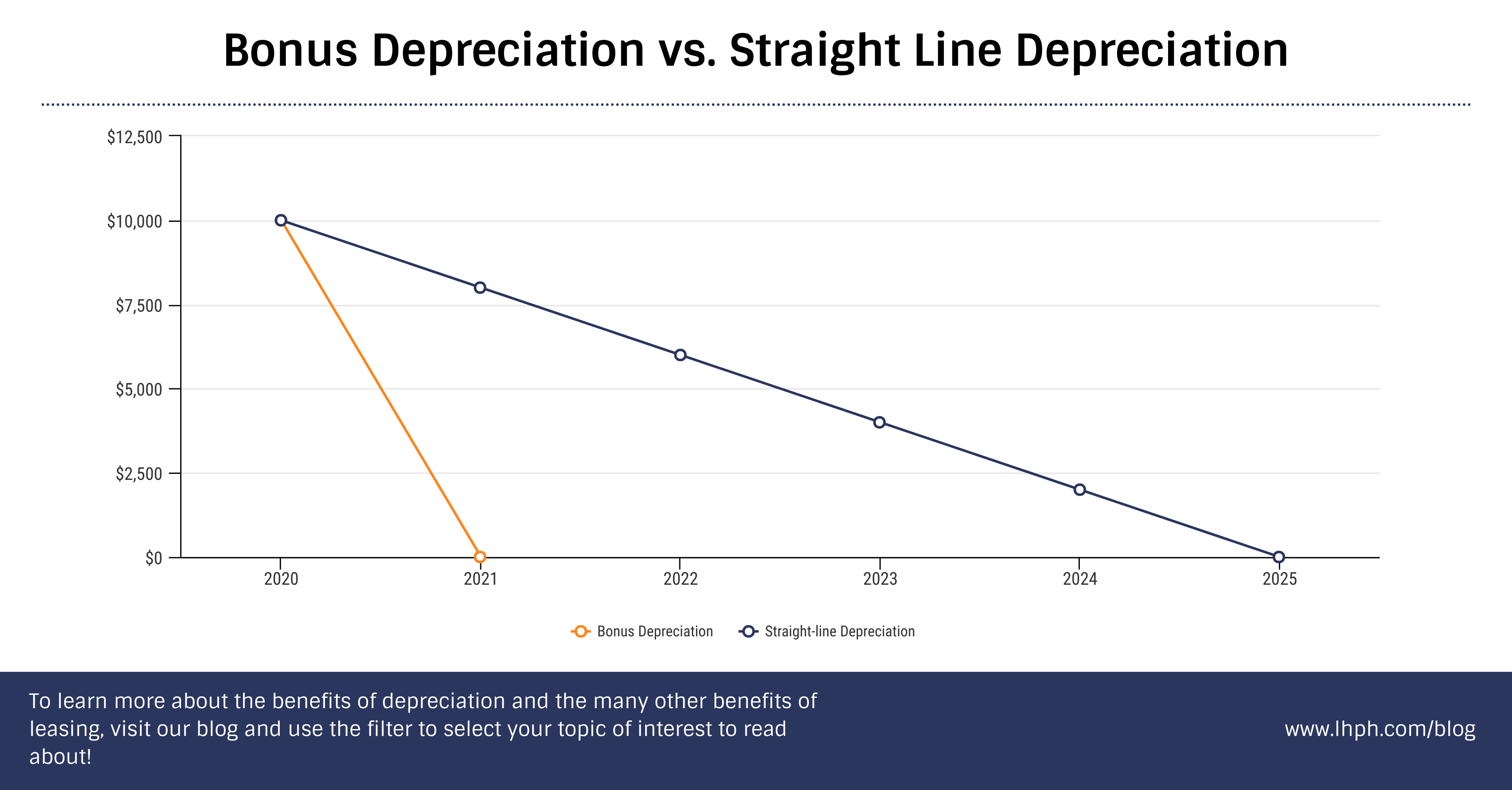

Bonus Depreciation 2024 Percentage Of Income. Bonus depreciation allows you to deduct a percentage of an asset’s cost, with no annual limits on the amount. The bonus depreciation deduction limit for the 2023 tax year is 80% of the asset cost, down from 100% in 2022.

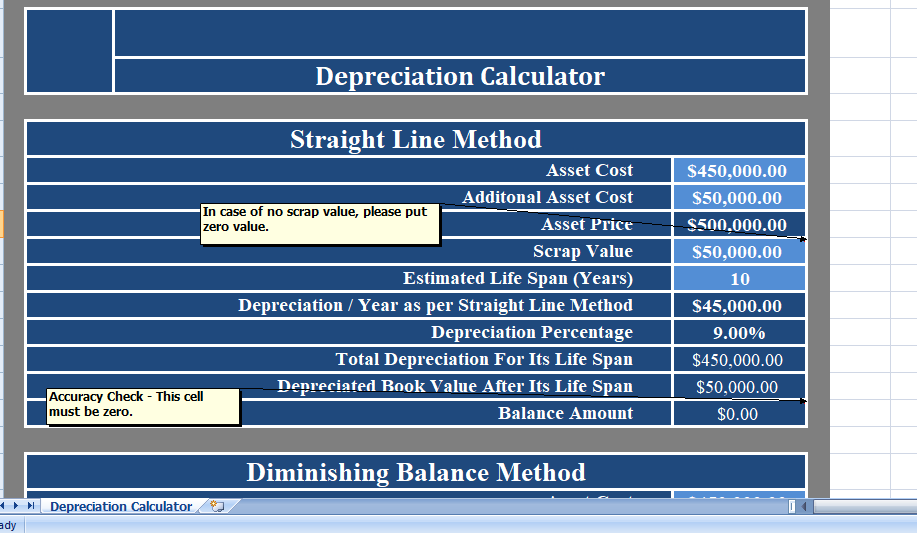

On the other hand, bonus depreciation isn’t limited by the business’ taxable income. If we’re in 2024, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate).

Bonus Depreciation 2024 Percentage Of Income Images References :

Source: allixychantalle.pages.dev

Source: allixychantalle.pages.dev

2024 Bonus Depreciation Percentage Calculator Lenna Nicolle, Bonus depreciation deduction for 2023 and 2024.

Source: angelavangelita.pages.dev

Source: angelavangelita.pages.dev

Bonus Depreciation Percentage For 2024 Delila Chrysler, Bonus depreciation allows businesses to deduct a large percentage of the cost of eligible purchases in the year when they acquire them.

Source: rhonaybernardine.pages.dev

Source: rhonaybernardine.pages.dev

2024 Bonus Depreciation Percentage 2024 Devora Ermentrude, The remaining $4,000 will be depreciated in future years according to.

Source: joyywilhelmine.pages.dev

Source: joyywilhelmine.pages.dev

Bonus Depreciation 2024 Erica Aindrea, 20% this schedule shows the percentage of bonus depreciation that businesses can claim for.

Source: ninonqfrances.pages.dev

Source: ninonqfrances.pages.dev

Bonus Depreciation 2024 Percentage Change Ted Shantee, The expensing limit was doubled from.

Source: daciayteirtza.pages.dev

Source: daciayteirtza.pages.dev

Bonus Depreciation 2024 Loren Jenelle, For an asset that is.

Source: angelavangelita.pages.dev

Source: angelavangelita.pages.dev

Bonus Depreciation Percentage For 2024 Delila Chrysler, This is down from 80% in 2023.

Source: nannyqshaylynn.pages.dev

Source: nannyqshaylynn.pages.dev

Bonus Depreciation Calculator 2024 Viki Melanie, In 2024, bonus depreciation continues to be a valuable tool for businesses looking to invest in new or used property, offering a deduction of a certain percentage of the asset’s cost in the.

Source: kristiwnancy.pages.dev

Source: kristiwnancy.pages.dev

2024 Bonus Depreciation Rates Jess Romola, What are the eligibility requirements for the additional first year depreciation deduction following the.

Source: darciyruthanne.pages.dev

Source: darciyruthanne.pages.dev

Bonus Depreciation 2024 Equipment Joby Melody, The remaining $4,000 will be depreciated in future years according to.